KEYNOTE SPEAKERS:

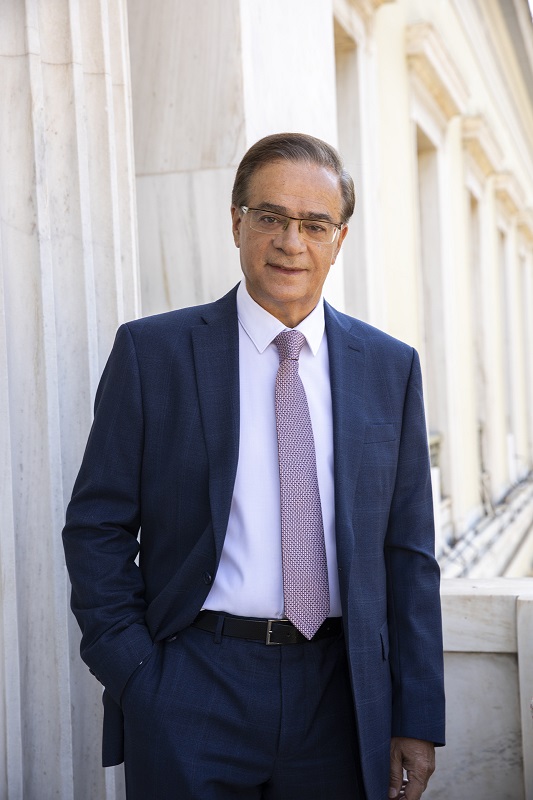

1. Gikas Hardouvelis, Chairman of the Board of Directors at the National Bank of Greece, Chairman of the Hellenic Bank Association, Emeritus Professor of Finance and Economics at the University of Piraeu.

Hardouvelis Gikas Personal Website - Γκίκας Χαρδούβελης

2. Geert Bekaert, Columbia University, USA

Geert Bekaert is Professor of Finance and Economics at Columbia Business School Before joining Columbia, Geert was a tenured Associate Professor of Finance at the Graduate School of Business, Stanford University. He received his Ph.D. from Northwestern Universitys Economics Department, with his dissertation winning the 1994 Zellner Thesis Award in Business and Economic Statistics.

Geert Bekaert has published over 75 articles in the Journal of Finance, the Journal of Financial Economics, the Journal of Political Economy, the Review of Financial Studies and other academic journals. He is the managing editor for the Journal of Banking and Finance.

Geerts research focus spans international finance, empirical asset pricing, emerging markets, and investment and asset allocation problems. His research has been supported by two NSF grants.

Geert has taught classes on International Financial Markets, Global Fixed Income, Empirical Asset Pricing (for PhDs), Financial Time Series Econometrics, Capital Markets and Investments, Investment and Wealth Management and Asset Management. With Robert Hodrick, he is the author of a textbook on International Financial Management.

Geert consulted for several asset management firms, and developed models for Financial Engines (taken private in 2018) and Betterment, both robo advisors.